Back in 2011, I happened to be involved in what to my mind are the only pilots on Universal Basic Income (UBI) in India. Never did I think, then, that UBI would become such a buzzword in policy circles.

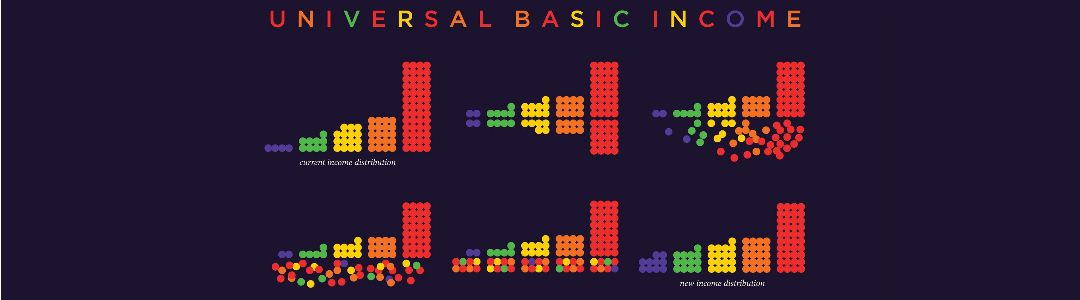

The concept of a universal basic income is simple. It is an unconditional, regular payment made to every citizen as a form of social security. While the idea is old, it has been gaining currency of late around the world, given an environment of high inequality, increased automation and rising unemployment. In developing countries like India, it is increasingly being seen as a tool for fighting poverty. The Prime Minister has mentioned the concept in his recent speeches. The government’s Economic Survey, 2016-17, has detailed extracts on how a regular, unconditional and uniform cash transfer to every adult and child can promote social justice and empower the poor to make their own economic choices.

The idea, however, has invited its share of scepticism. Wouldn’t an unconditional payment be akin to charity? Would it encourage sloth, vices like addiction to alcohol? Should all Indians, including the rich, be guaranteed a basic income? Should UBI be a substitute to or complement existing welfare schemes such as the Public Distribution System (PDS) or the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA)? And most importantly, even if the government announces it, will it be able to afford it and implement it?

Some of these dilemmas were answered by our pilots. Funded by UNICEF and coordinated by the Self-Employed Women’s Association (SEWA), the two pilots in MP involved paying every adult and child, a monthly payment of Rs. 300 and Rs. 150 respectively, for a year in eight non-tribal villages and a tribal village in MP. Other villages were visited for comparison.

First, we undertook the experiment because we believed that people are generally capable of making decisions which are in their own best interests. In other words, the state need not act as the all-knowing benefactor.

Here, the people in our pilot villages did not disappoint us. We found no evidence of an increase in spending on alcohol. In fact, we found people spending on their children’s food, their education, on their household requirements, on household repairs. We also did not witness a rise in ‘sloth’. On the contrary, we saw an increase in income earning and production, now that some extra funds allowed families to buy seeds and fertilizers. People worked more hours and branched out into secondary activities. The ‘dole’ or ‘charity’ was seen by them as a rare chance to invest money wisely, so it would pay them later.

The second dilemma is a financial one. The Economic Survey suggests that a basic income of Rs. 7,620 per person, every year would bring everyone but India’s very poorest above the poverty line of Rs. 893 per month. Even if this amount is paid to only three in every four Indians – some measure of exclusion of the non-poor being applied (e.g. those owning land, consumer goods like refrigerators being excluded) – the total cost to the government would be about 4.9% of GDP, far higher than the present welfare schemes of subsidies on food, fertilizer and fuel which cost about 2.07% of GDP. This means that the government would have to consider removal of additional subsidies which also benefit the non-poor, including the middle class, for example subsidized train travel and loans – a politically challenging decision considering the resistance to demonetization.

The article is written by Ms. Soumya Kapoor Mehta, Development Economist and Co-Author of Basic Income: A Transformative Policy for India for FICCI’s Economy Watch.

The article is written by Ms. Soumya Kapoor Mehta, Development Economist and Co-Author of Basic Income: A Transformative Policy for India for FICCI’s Economy Watch.