Latest round of FICCI’s Business Confidence Survey reported signs of moderation in the optimism level of corporate India. The index value slipped to 66.3 according to the results of FICCI’s latest survey round, which is a six quarter low. The index value stood at 73.2 in the previous round.

The build-up in confidence noted since Government assumed office last year has been encouraging, however the same momentum needs to be sustained going ahead.

The survey drew responses from about 130 companies with a turnover ranging from Rs 6 crore to Rs 92,000 crore and belonging to a wide array of sectors like steel, food processing, paper and paper products, plastic and plastic products, oil and gas, electrical machinery products, infrastructure etc. The survey gauges expectations of the respondents over the period July to December 2015.

Results of the Business Confidence Survey

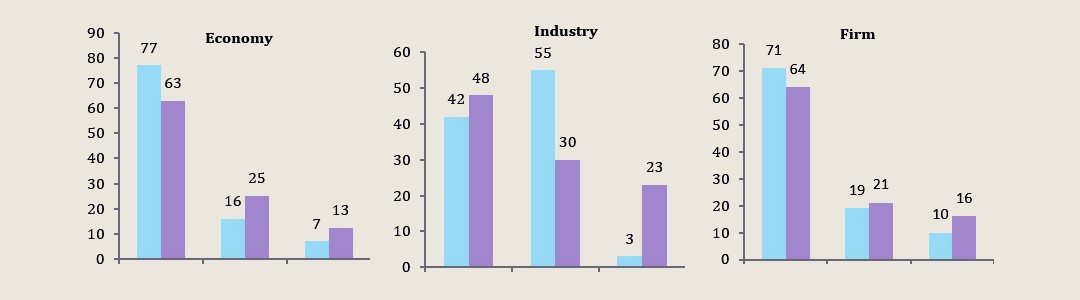

- Participating companies did not report much improvement in the current conditions vis-a-vis last six months at the economy and firm level.

- Economy level: proportion of respondents citing ‘moderately to substantially better’ performance vis-a-vis last six months declined to 66% in the present round from 73% stating likewise in the previous round. This perception of respondents finds ground in the actual economic data as well; a firm rebound in the economy still remains elusive.

- Industry level: a slight increase was noted in proportion of respondents indicating improved conditions compared to last six months.

- Near term expectations note some restraint. In the current round even though a majority of respondents said that they anticipate a ‘moderately to substantially better’ performance over the next two quarters, the proportion of companies that hold this view has moderated when compared to the previous survey round.

- Economy level: In the latest survey about 78% of the respondents said that they foresee an improved performance at the economy level in the coming six months; the corresponding figure in last survey was 94%.

- Industry level: At the industry level, 71% of the respondents cited a better performance in the coming six months in the present round, vis-à-vis 87% stating the same last time.

- The corporate results for the first quarter of this fiscal year indicated weak performance owing to a host of domestic and global factors.

- Capacity utilization: at companies remains low with about 50% of the participants reporting that they are operating at below 75% capacity.

- In addition, results with regard to operational parameters indicate mixed signs.

Even though the proportion of respondents anticipating an increase in investments, profits and employment noted an increase in the latest survey round; this was offset by an increase noted in the proportion of participants foreseeing worsening for these parameters. Further, the outlook of the respondents with regard to sales and exports also took a beating.

- Investments: In the current survey, 43% of the respondents said that they expect higher investments over the next six months, vis-à-vis 38% stating likewise in the previous round. However, the proportion of respondents anticipating lower investments went up to 9% in the present survey from 3% last time.

- Profits: Likewise with regard to profits, while the proportion of respondents foreseeing higher profits increased to 37% in the current survey from 32% last time; those anticipating a decline increased to 17% from 3% in the last survey.

- Sales: 66% of the respondents in the current round expected higher sales over the near term, vis-à-vis 73% stating likewise in the last round.

- Exports: With the global recovery remaining fragile, export prospects remain weak. In the current survey, 48% respondents anticipated higher exports, 11% points lower than those stating likewise in the last round.

- Imports: In addition, an increase was noted in the proportion of respondents citing threat of imports to be a constraint. According to the survey results, 44% of the participants indicated rising imports to be a worry for them, vis-à-vis 40% stating likewise in the last survey. The corresponding figure a year back was 28%. Those indicating imports to be a concern belonged to sectors like steel and steel products, agricultural machinery, textile machinery, food processing, electronic products, paper products, plastic products and chemicals.

- Demand: Weak demand situation has been cited to be a concern by almost 71% of the companies in the present survey and this has been a persistent concern for almost a year.

Cost of Credit: Despite the Reserve Bank of India undertaking three rounds of cut in the repo rate in this calendar year, cost of credit was reported to be a bothering factor by 58% of the respondents. In the previous round 55% companies had stated likewise. It may be noted, the Banks have cut the lending rate by about 25-30 bps and we are yet to see a full transmission of the cuts in repo rate.

Read our complete July 2015’s Business Confidence Survey