There are three key aspects of a Universal Basic Income (UBI) scheme. First, it is universal, that is, it is not targeted to any specific group based on any socio-economic criteria. Second, it is an income or cash transfer scheme, not any specific good or service being provided in-kind or in a subsidized manner. Third, it is not contingent on compliance with any behavioural standards. This differentiates it from cash transfer schemes that are conditional on specific behavioural criteria for the recipients. For example, Latin American countries like Mexico and Brazil have programmes where families get a certain income transfer conditional on children attending school and family members receiving preventive health care.

The main strength of the UBI is it is simple and robust to various problems that afflict most anti-poverty programmes.

More Efficient

First, any programme that is not universal (e.g., food subsidies or employment guarantee) is associated with the direct or indirect administrative costs of targeting the relevant group. It also creates scope for inefficiency, errors of inclusion and exclusion (those who are not eligible getting it, and those who are eligible not getting it, respectively), and corruption.

Does not interfere with market forces

Second, being a lump sum transfer of cash, it does not directly interfere with the operation of market forces in ensuring efficient resource allocation. This is a problem that is severe in the case of subsidies or free provision of certain goods and services that are also available on the market (e.g., food, fuel, fertilizer). They create excessive use by some, rationing for others, and in general stimulates the black-market by having multiple prices for the same good or service.

Not contingent upon monetary compliance

Third, not being contingent on any behavioural norms of recipients, it avoids setting up an entire administrative machinery aimed at monitoring compliance. This not only avoids the direct and indirect costs of running such a bureaucracy, it also removes the patron-client relationship that is inherent in any system of monitoring and rewards between the state and its citizens that is undesirable in a democracy.

Not just that, it allows individuals freedom of choice as to how to spend the money based on their specific needs and priorities.

Being a lump-sum transfer, it also does not directly interfere with the decision of individuals regarding productive activities, whether it is in terms of location or occupational choice or employment status. It could be argued it reduces the incentives to work by surviving without working possible. But working, like saving or investing or renting out property is one of many economic decisions that individuals take. A flat transfer can only affect it through what economists call an income effect – if you feel more affluent you may want to work less, which will also happen if wages or salaries go up. Given that the amounts being talked about in the Indian context are rather small (for example, Rs1200 per person per month would be the average amount according to my calculations) it is unlikely that having a minimum income will significantly interfere with the incentives of individuals to undertake productive activities.

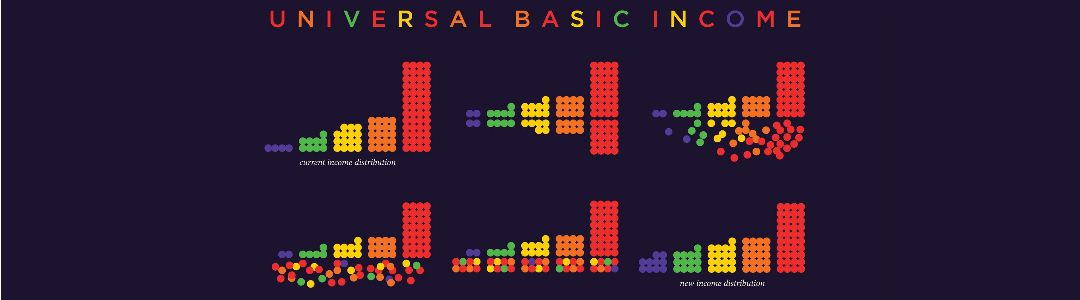

It may appear that since both the rich and the poor will receive the same amount of income under a UBI scheme, it is not progressive or fair. However, this is a misconception as the rich pay taxes and will be net contributors while only the very poor will be net recipients of income under a UBI scheme. It is similar to our income tax scheme where a certain minimum level of income is not subject to tax for everybody, except for here the absolute minimum income is not zero, but a lump-sum transfer from the government.

Most of the opposition to UBI comes from the worry that the government would simply wash its hands off from any other forms of expenditure that the poor would benefit from, such as on health and education. Clearly expenditures on health and education are investments in human capital, and affect the growth potential of the economy, similar to investments in infrastructure. These should be delinked from any anti-poverty programmes, whether UBI or some other form of conditional or in-kind transfer, which provide short-run relief to the poor as opposed to a long-term solution.

The article is written by Prof. Maitreesh Ghatak, Professor of Economics, London School of Economics for FICCI’s Economy Watch.

The article is written by Prof. Maitreesh Ghatak, Professor of Economics, London School of Economics for FICCI’s Economy Watch.