Almost every type of financial activity - from banking to payments to wealth management and more - is being re-imagined by some tech savvy banking incumbents as well as by startups.

International experiences of implementing Universal Basic Income

Low density of banks and weak banking networks in remote rural areas coupled with the case where welfare schemes and UBI are implemented in parallel could pose a challenge to UBI

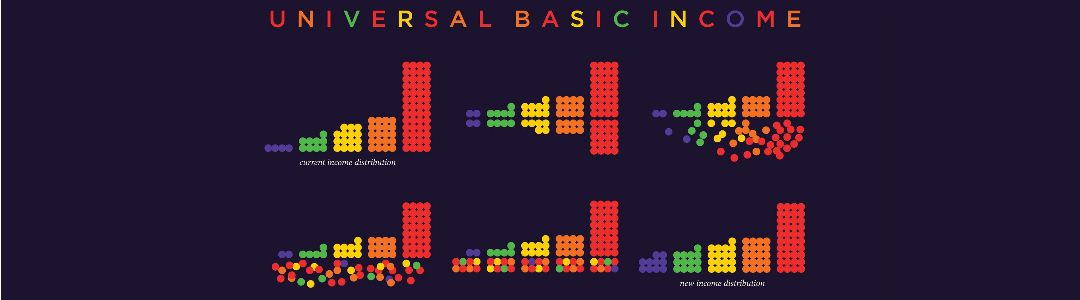

The Economic Survey has presented Universal Basic Income as a single scheme which could replace this myriad of welfare programs with a simple unconditional cash transfer to every citizen paid at regular intervals.

Over the next 15 years, India will continue to be a young country, with a very large part of the population below the age of 30, which means that the need for life insurance, i.e. the need for life...

The whole cycle of getting quotes to policy acquisition to policy servicing to proactive claims identification, assistance and processing will have to take the digital route to improve customer experience